Emerging markets external balances – still going strong

China posted another large trade surplus in October (USD$84.54 billion), as exports accelerated more than imports. The growth rates of both exports and imports seemingly 'ignored' supply chain disruptions and energy shortages, but the discrepancy between value and volume growth shows that exports momentum is slowing, which should be expected as the rest of the world is reopening after the pandemic. In regards to imports, major commodity imports are still down in volume terms (except for coal and brown coal), in line with what other indicators pointing to an uneven domestic recovery. For now, the central bank is staying on the sidelines, providing market liquidity but no additional easing in the form of lower reserve requirements of rate cuts. The release of China’s credit and monetary aggregates later this week should give us more color regarding other types of stimulus, including fiscal.

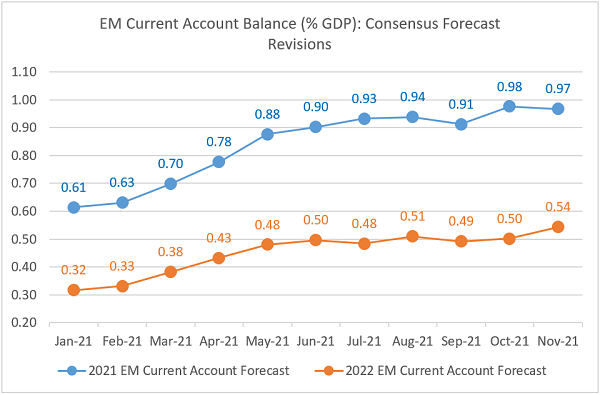

The sell-side interpretation of China’s surging trade and current account surpluses was mixed, but stronger external surpluses in other parts of emerging markets (EM) are more straightforward. In many cases this is a consequence of using currencies as 'shock absorbers' (this helps to keep imports in check), but the global reopening is also a boon to EM exports, the economic surprise index for EM exports is still in positive territory. Finally, some emerging economies are benefitting from improving terms of trade. It remains to be seen whether all of these trends continue in 2022, but the consensus is quite optimistic, upgrading the EM current account forecasts for both 2021 and 2022 (see chart below).

A combination of better than expected external balances and rising international reserves, another 'side effect' of using FX as a shock absorber, because it reduces the need for currency interventions, helps to explain why the year-to-date total return on EM sovereign bonds, as represented by JP Morgan’s EMBIG Index, looks better than the total return on EM local debt, as represented by JP Morgan’s GBI-EM Index (unhedged). This is a good illustration for our long-standing argument that EM sovereign debt is relatively well-anchored these days giving investors an opportunity to express a positive view on EM.

Chart at a glance: Consensus keeps upgrading emerging markets current account forecasts

Source: VanEck Research; Bloomberg LP

Published: 08 November 2021