China – light at the end of the tunnel?

There was the property slowdown, provincial COVID resurgence and a tech clampdown, but now there’s some good news for Chinese equities. For the past 18 years, Chinese A-shares have exhibited strong seasonality in Q4, and history looks to potentially repeat itself.

|

% of Positive Return |

Average Return |

Median Return |

|

|

Q1 |

61% |

5.4% |

1.8% |

|

Q2 |

44% |

-0.7% |

-1.3% |

|

Q3 |

50% |

1.6% |

-0.2% |

|

Q4 |

67% |

6.6% |

4.4% |

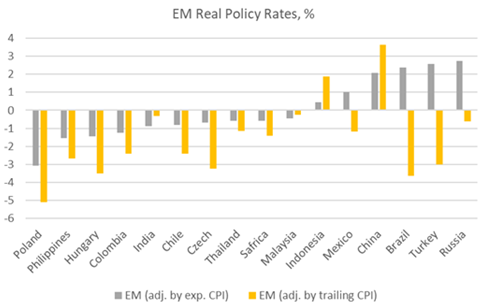

On the monetary policy front, China is standing as an overachiever with elevated real rates, high even compared to many emerging markets. Should the property slowdown drag further on growth, China would have easing space up their sleeve. According to CSLA research, policy easing and elevated risk premium in China high yield credits could signal outperformance in Chinese equities, along with the seasonality tailwind.

EM Real Policy Rates (%)

Source: VanEck Research; Bloomberg as of 25 October 2021

The equity market sentiment may further improve as we head toward the end of the year with more supportive measures related to the power supply constraints and property sector. The power shortage could steadily recover as the China Securities Regulatory Commission (CRSC) announced plans to curb excessive speculation in the price of thermal coal last week. It is also reported that regulators urged some major banks to accelerate mortgage approvals in Q4.

Now may be a good entry point in China A-shares by selecting sectors that are less likely to be subject to regulatory risks and companies with sound fundamentals. Learn more about opportunities to invest in China by exploring our ETFs, CETF and CNEW.

Published: 04 November 2021